Did the Federal Reserve’s Interest Rate Hike Boost the Price of Bitcoin?

We’ve discussed in the past about how certain asset classes are correlated. The stock market and the crypto market tend to move in patterns.

Bitcoin’s price has also become increasingly correlated with the stock market:

As the image illustrates, the correlation became most evident in early 2017, which was also a very bullish year for both Bitcoin and the stock market.

Datatrek, a research consultancy has analyzed three holding periods of 10 days, 30 days, and 90 days for Bitcoin and the S&P 500 since January 2016. They found that there was a 79% and 52% correlation in Bitcoin and daily S&P 500 price movements. On a 90-day basis, that figure has a correlation ratio of 33%.

“Since investors have only one brain to process risk, they will make similar decisions about cryptocurrencies and stocks when they see price volatility in the latter,” – Datatrek Analyst.

Also, Bitcoin has generally seen a boost when major world fiat currencies such as the Chinese Renminbi, Argentina’s peso or the Venezuelan dollar start to weaken or inflate significantly, forcing people to seek stability elsewhere.

Correlation with Interest Rates

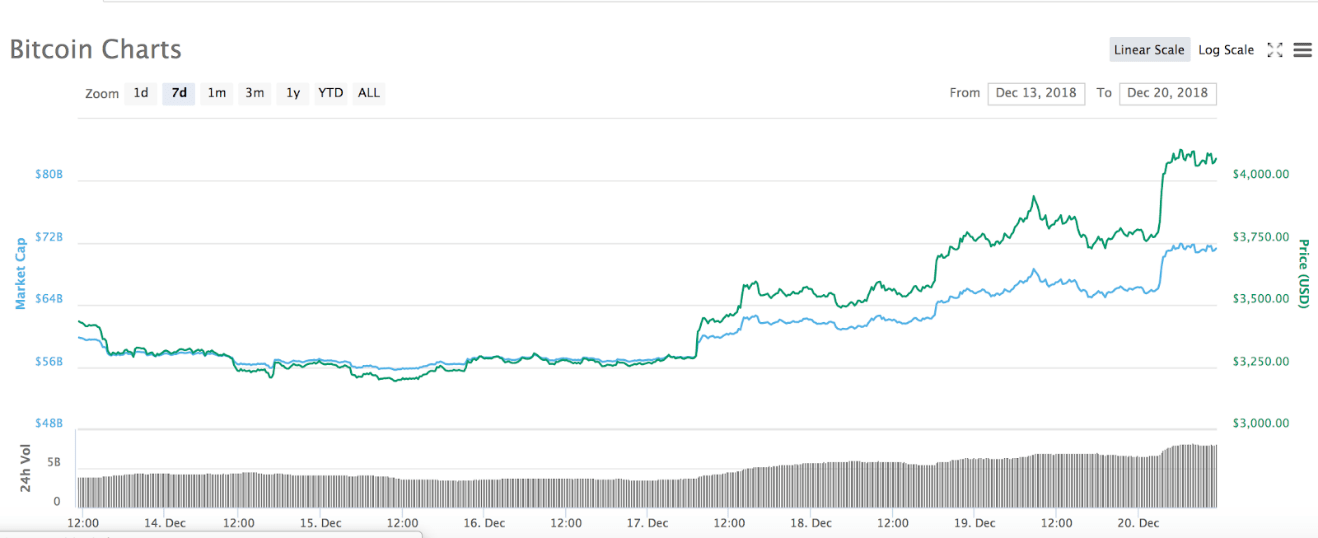

In today’s analysis, we believe there is a positive correlation between the Federal reserves recent decision to raise interest rates by 2.5%, and Bitcoins price jumping back to $4k from $3,200.

Interest rates are a key determining factor in an individual or entities ability to borrow money. Low-interest rates mean that money can be borrowed cheaply because you don’t have to pay back much more than you borrowed. High-interest rates make borrowing more expensive because you have to pay back the amount owed, plus perhaps an addition 5,10 or 15% more (depending on your level of trustworthiness as a borrower).

The Federal Reserve usually raises interest rates as a way to cool down the market in times of a bubble (when assets are overbought, and prices are too high compared to the real value of an asset).

Much of what drives people and businesses to invest in things such as real estate or stocks is access to low-interest rate loans. The easier it is for me to borrow more money, the more of that money I can allocate to stocks or other investments.

Low-interest rates can therefore often coincide with bull runs in the stock market.

Now when the Federal Reserve decides to increase interest rates (or even if there is mere speculation that interest rates could go up), investors become bearish and sell their stocks because they anticipate that fewer people will have access to cheap loans that they can pour into the stock market.

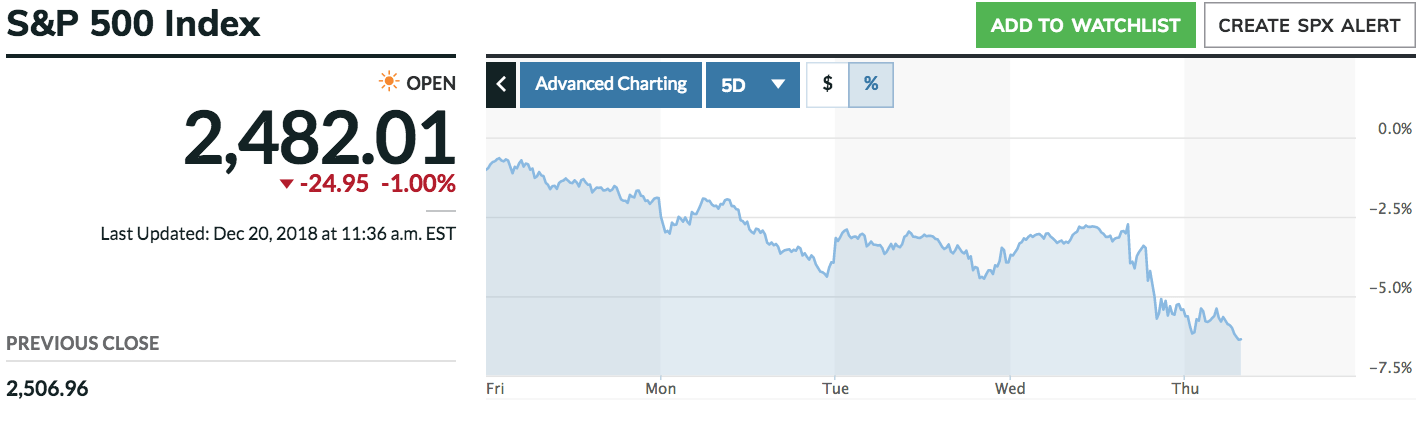

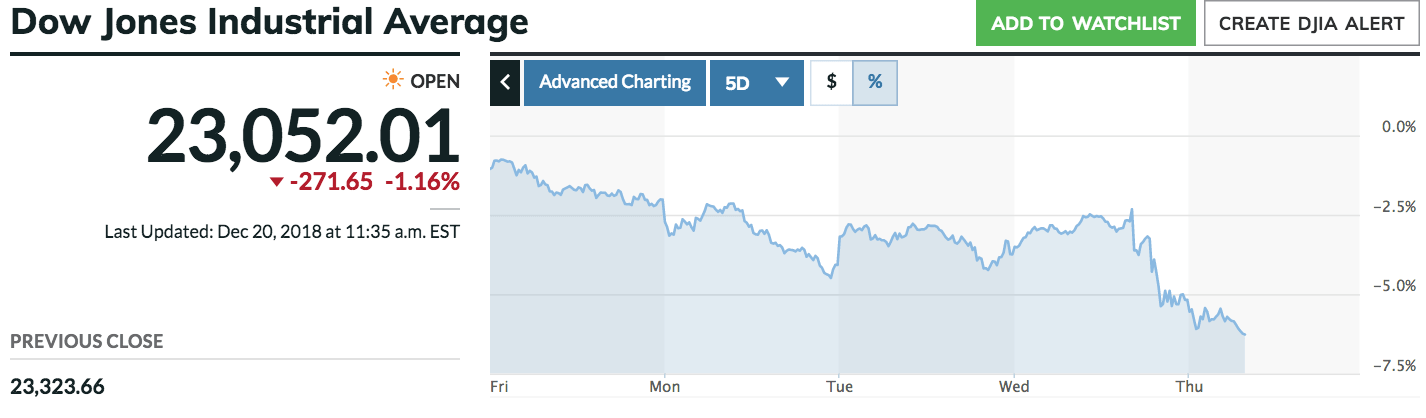

Interest rates rose by 2.5% yesterday, while the Dow Jones and S&P 500 dropped by about 5% each in the past five days leading up the interest rate hike.

Meanwhile, Bitcoins price went up by more than $800 in the past 5 days.

A possible reason for this is that some stock investors may have decided to shift their funds from stocks to crypto. Usually crypto wouldn’t be the ideal second choice (Gold or Bonds are typically next in line after stocks for savvy investors). However, with Bitcoins price dropping by almost 50% in the past three weeks, it presented an excellent opportunity for stock investors to transition into an oversold asset at just the right time.

Ultimately, predicting which asset classes will perform well when others are performing poorly is never an exact science. However, with a basic understanding of economics and by observing patterns of overselling, a solid case can be made for Bitcoins current price hike. How long it lasts and where it will top off remains to be seen.

The post Did the Federal Reserve’s Interest Rate Hike Boost the Price of Bitcoin? appeared first on CryptoPotato.