Swiss Bitcoin ETP Sees Record Volume as Institutional Investors Buy the Dip

The steep decline in Bitcoin price has coincided with record volume of the recently launched Bitcoin ETP on the SIX Swiss Stock Exchange, suggesting that institutional investors are may be buying the dip.

Bitcoin ETP $HODL Sees Record Volume

Earlier in November, Bitcoinist reported that a Bitcoin exchange-traded product (ETP) with the HODL ticker offered by Amun Crypto was about to begin trading on Switzerland’s SIX Exchange.

The ETP represents a fully collateralized and non-interest-paying bearer debt security, which is issued as a security and traded and redeemed in the same structure. Bitcoin comprises the largest share of the HODL ETP at 48%, followed by XRP (30%), Ethereum (17.6%), and smaller shares of Bitcoin Cash and Litecoin.

There is a notable difference between an ETP and an ETF, however. The former is not subjected to the Collective Investment Schemes Act (Cisa) and is therefore not supervised by Finma.

The HODL ETP is underlined by an index comprised of four major cryptocurrencies, namely BTC, ETH, XRP, and LTC.

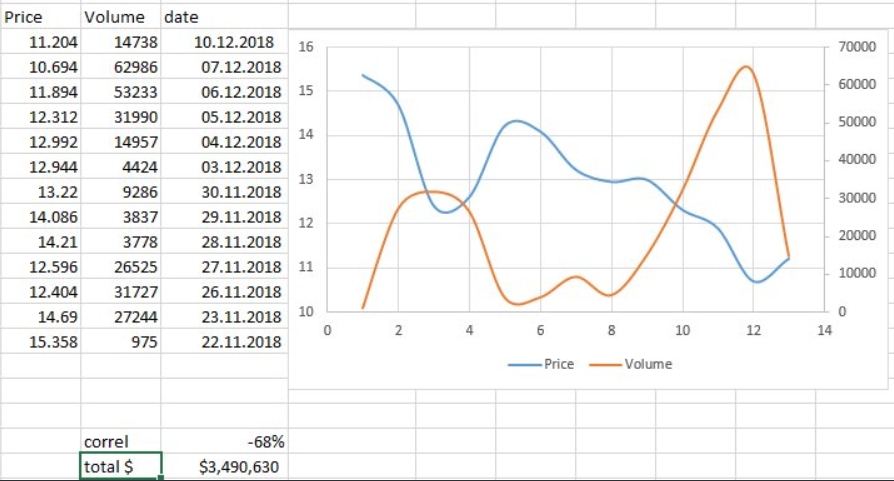

Interestingly enough, last Thursday and Friday, the ETP saw record trading volumes with 53,233 shares and 62,986 shares traded, respectively. This is a serious increase from the one-month average volume that saw around 20,000 shares traded per day and coincides with a steep decline in Bitcoin price at the end of last week.

According to Su Zhu, CEO at FX Hedge Fund, the “correlation between volume and price continues to be very strong at -68%.

Last Thurs and Fri we broke volume records again on the Swiss HODL ETF with 53,233 shares and 62,986 shares traded respectively. That coincided with the dip in BTC to 3.2k and ETH to near 80. The correlation between volume and price continues to be very strong at (-68%). https://t.co/Meuaa9MXCV

— Su Zhu (@zhusu) December 11, 2018

Institutions Buying the Dip

Zhu notes that there is a negative correlation between price and volumes observed with the HODL ETP. In other words, the ETP’s trading volume increases as BTC price dips and decreases as price rises, as observed in the chart below.

According to the expert, a very high percentage of the volume is also net inflow which suggests that users buying the ETP are holding rather than trading.

Bitcoinist recently reported that users in Argentina and Venezuela might also be buying the dip, based on new data from P2P Bitcoin trading platform LocalBitcoins.

What do you think of the increased volume in the HODL ETP? Don’t hesitate to let us know in the comments below!

Images courtesy of Shutterstock, Twitter @zhusu

The post Swiss Bitcoin ETP Sees Record Volume as Institutional Investors Buy the Dip appeared first on Bitcoinist.com.