What is Bitcoin Halving? Will it Trigger the Next Bull-Run?

The next Bitcoin halving is less than 500 days away, and the Internet at large is speculating about its impact on the price, miners, and so forth. But to understand why this event is so crucial for the overall performance of the world’s largest cryptocurrency, there are quite a few things to be aware of, especially when it comes to Bitcoin mining and the way the network functions.

Bitcoin Mining: Abstract

Even though they are seemingly distinct, you can identify similarities between Bitcoin mining and mining precious metals like gold, for instance. Both of those activities are carried out to earn a reward.

Furthermore, both processes are energy intensive. In gold mining, it’s a matter of a physical use of energy through machines and manpower to excavate the gold from the ground. However, with Bitcoin mining, the energy is mostly electricity, which is used to solve complex and difficult computational puzzles.

How Does it Work?

Mining is the beating heart of the Bitcoin network. Miners are the ones who replace centralized entities like banks, and they maintain the payment network. Without them the network could not be secured and accountable. The reward is the way miners are incentivized for their necessary actions.

When a person with a Bitcoin wallet decides to transfer Bitcoin from his wallet’s Bitcoin address to some other wallet’s address, he has to create a transaction and sign it using his private and public key and broadcast this signature transaction to the Bitcoin network. Eventually, the goal is to add this new transaction to one of the next Blocks that will be added to the Bitcoin blockchain.

The job of miners is to pick up those transactions and encapsulate them into a list of transactions which make up a Block. In this process, the miner needs to verify each transaction they add and make sure there is no double spending.

Next, the miner needs to broadcast the new Block he just created to the network. If the miner succeeds in doing so before any of the other miners, he will be rewarded with a fixed amount of new BTC that will be reflected in his Bitcoin address. To do so, the miner will have to perform the second part of the mining process – solving a complex computational mathematical puzzle.

Simply put, the miner will have to come up with a certain 64-digit hexadecimal number which is called a nonce. This nonce will have to have a unique mathematics characteristic when calculating a particular function called a hash function. A hash function is a mathematical function that takes as an input an arbitrary amount of data and outputs a fixed-sized number. There is no real way to predict the output of the Hash function other than calculating the function.

In this case, the hash function will take as an input the block’s data which includes all the transactions, the block’s metadata, and the nonce. The goal is to find a certain nonce that when it is assigned as an input to the hash function together with the other inputs will output a number which is lower than a certain threshold.

The catch is that the only way to find this nonce number is to guess. Therefore, miners are required to guess an enormous amount of numbers until they find the right one which fits the requirements. So, miners who have a larger amount or more efficient computational power will be able to guess faster and therefore, increase the possibility of them solving the puzzle first. The number of “guesses” that the computer produces per second is referred to as the “hash rate.”

Each time a computer comes up with the right 64-digit number, a new Block is broadcast to the network. The moment this happens, the miner is rewarded with the so-called Block reward. This is nothing but a pre-determined amount of Bitcoin. Currently, the Block reward is 12.5 BTC per block. Apart from acting as an incentive mechanism, the Block reward also operates as an inflation mechanism which adds new Bitcoins to the market. The current state of the network produces one Block roughly every 10 minutes, meaning that, there are about 1,800 new Bitcoins mined every day.

That’s not the only source of profit for miners, though. As we mentioned above, miners keep the state of the network secure as they also confirm its transactions. For this, they get paid in transaction fees. Each day, depending on the network conditions, there are hundreds, if not thousands of Bitcoins paid in transaction fees.

What is Bitcoin Halving?

Back to our central question.

As you probably know, the amount of Bitcoins that will ever exist is capped at 21,000,000. As soon as the last one of these is mined, there will be no new Bitcoins added to the network.

As we already know, new Bitcoins are produced as miners solve complex math problems and receive them as Block rewards. The amount of Bitcoin rewarded to the miner for solving the problem, however, hasn’t always been the same.

See, unlike today, the Block reward was initially set to 50 BTC per Block. In other words, during the first days of Bitcoin, whoever managed to discover a valid Block would get 50 BTC in return. If that had remained the same, the 21 million BTC cap would have been reached in about eight years.

However, the Bitcoin network was created in a way where the Block reward is decreased over time to create a self-sustaining and secure environment where nodes are incentivized to support the network. Bitcoin’s whitepaper compares this process to gold mining:

“The steady addition of a constant of amount of new coins is analogous to gold miners expending resources to add gold to circulation. In our case, it is CPU time and electricity that is expended.”

This is where Bitcoin halving steps into the picture. This is the event which slashes the block reward in half – hence, halving. As Bitcoin is an open-source project, the lines of code which enable Bitcoin halving are readily accessible to anyone on the Bitcoin Github repository:

Consensus.nSubsidyHalvingInterval = 210,000

This line of the code reveals that a halving event will take place every time 210,000 blocks are generated. It has been estimated that this will happen approximately every four years.

Furthermore, there is one more line in Bitcoin’s code which is also quite important. It reads:

If (halvings >= 64)

return 0;

This means that once there have been 64 Bitcoin halvings, the network shouldn’t see any more Bitcoins added to it.

How Have Many Bitcoin Halvings Happened So Far?

So far, there have been two previous Bitcoin halvings. The first one took place on November 28th, 2012. It reduced the block reward from 50 BTC to 25 BTC.

The second halving was on July 9th, 2016 – it reduced the block reward to the current 12.5 BTC per block. The next one is estimated to take place on May 2nd, 2020 when the block reward will drop to 6.25 BTC per block.

We reach the point where people get hyped about Bitcoin halving and its impact on the cryptocurrency’s price.

Historically, there seems to have been a positive correlation between Bitcoin halving events and its price. The periods following the halvings of 2012 and 2016 have both been particularly lucrative for the cryptocurrency.

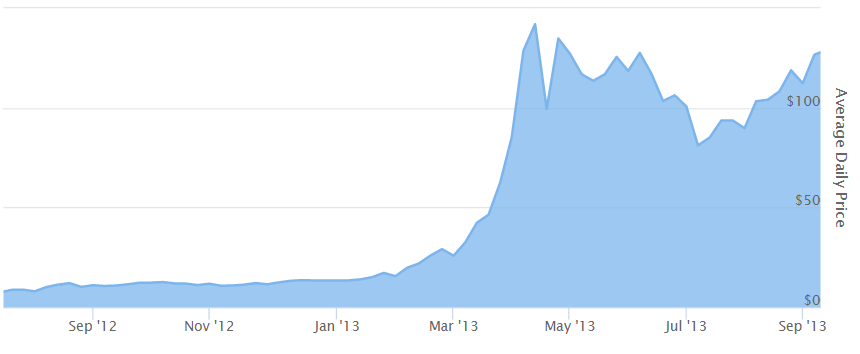

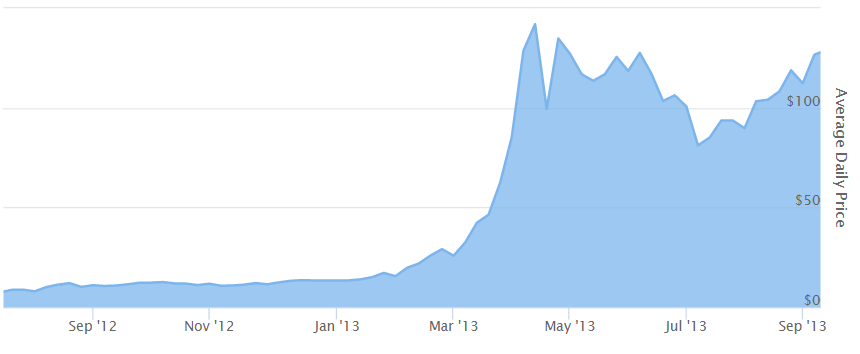

On the day of Bitcoin’s first halving – November 28, 2012, BTC was trading at around $12. In September the following year, its price had increased by a factor of 10x, trading upwards of $120.

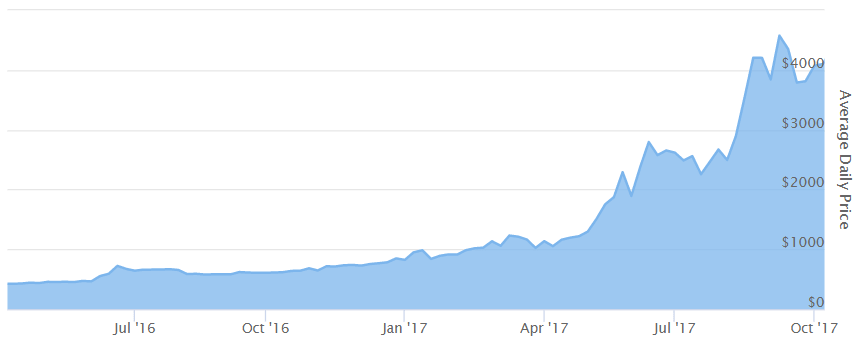

During the second halving day – on July 9th, 2016, BTC was trading at around $650. As seen from the chart, the cryptocurrency increased by more than 400% in the following year, eventually hitting its ATH value upwards of $20,000 towards the end of 2017’s unparalleled rally.

As the date of the next halving approaches, various industry experts have shared their take on the price of Bitcoin during the halving year of 2020. Earlier this year, the Chief Analyst at Fundstrat Global Advisors, Tom Lee, predicted that BTC would reach a whopping $91,000 by 2020.

Some have even gone so far as to bet on the price of Bitcoin by 2020. Civic’s CEO and co-founder Vinny Lingham recently bet Ronnie Moas, director and founder at Standpoint Research, that Bitcoin won’t reach $28,000 by 2020. The loser has to donate $20,000 to charity.

What Happens When There Are No More Bitcoins Left to Mine?

Naturally, a logical question would be what will happen to Bitcoin miners when the last Bitcoin has been mined?

As we explained above, Bitcoin miners, besides competing for Block rewards, also profit from transaction fees. As the network grows and becomes more widely accepted, it is entirely possible that by 2140 transaction fees could be profitable enough for miners to continue their work indefinitely. This is precisely Nakamoto’s vision:

“Once a predetermined number of coins have entered circulation, the incentive can transition entirely to transaction fees and be completely inflation free.”

It’s clear that the Bitcoin halving events have a severe impact on Bitcoin’s network and they guarantee its continued viability.

The post What is Bitcoin Halving? Will it Trigger the Next Bull-Run? appeared first on CryptoPotato.